Candidates for this presidential election have addressed the issue of higher education and its importance in the election, since an increasing amount of students continue to accumulate student loan debts and have difficulty finding jobs after graduation.

With less than a week until Americans vote on the fate of the election, the presidential perspective on higher education causes young college voters to decipher what a candidate says they can do and what they can accomplish once in office.

A recent study by the Pew Research Center reveals that one in five households in the United States owes double the share of money for student loans than in the previous two decades.

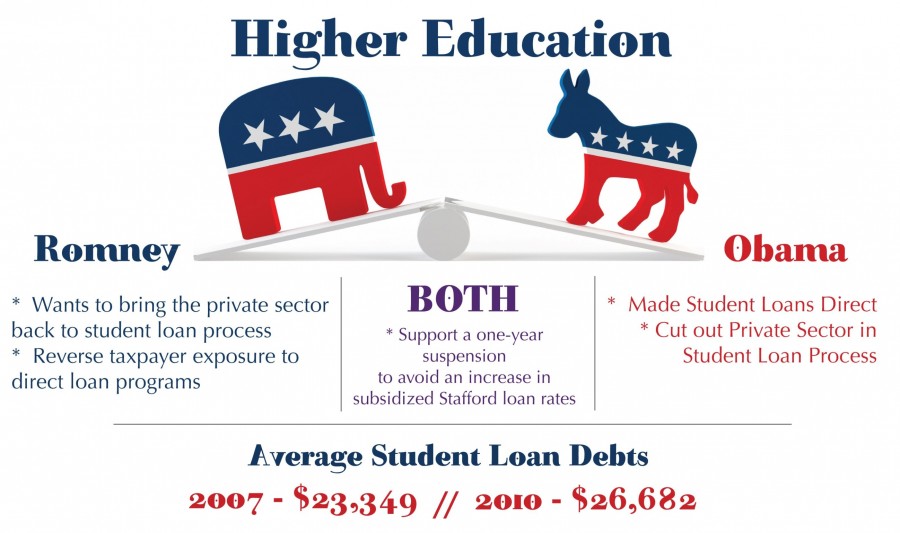

The average outstanding student loan debt in 2010 increased to $26,682 from $23,349 in 2007, according to the study.

“College expenses have gone up much faster than inflation,” Paul Wilson, history department head, said. “Students all across the country are finding it difficult to afford a four-year degree.”

During Obama’s presidency, he has worked to take out the middleman in the student loan process. Student loans are now considered direct loans, which are delivered and collected by private companies who have contracts with the Department of Education.

“We cut big banks out of the student-loan program and passed the savings directly to students,” Obama said in TIME magazine. “We stopped student-loan interest rates from doubling, gave nearly 4 million more young people scholarships to help them afford their degree and invested in our community colleges.”

The new direct loan process eliminates the step of the government giving subsidies to financial institutions that would make federal loans to students.

Republican nominee Mitt Romney opposes the process of the direct loan program because he said it increases the exposure to taxpayers and the cost of the program costs more than Americans are led to believe. Part of his plan is to return student loans to the private sector and reverse the effects of “nationalizing” student loans.

“We can provide opportunity without bankrupting this country, but America needs a new approach,” Romney said in TIME Magazine.

Wilson said, “I don’t particularly favor bringing back the middlemen because it just made some institutions enormously wealthy without any risk to those institutions because the government backed those loans.”

The Obama Administration has also fought for the suspension of an increase that would double rates on subsidized Stafford Loans. The one-year suspension kept interest rates from increasing from 3.4 percent to 6.8 percent.

Romney also supported the one-year suspension interest rate increase because of current economic struggles.

During Obama’s presidency, the President signed the Health Care and Education Reconciliation Act, which helped to invest more than $40 billion in Pell Grants, according to Insight into Diversity, a higher education magazine. The maximum amount for a Pell Grant increased from $4,371 in 2009 to the current $5,500. By 2017, the Health Care and Education Reconciliation Act would establish a rate of $5,975 for students.

However, recent changes to Pell Grants eligibility requirements only allow students to use them for 12 semesters, instead of the original 18 semesters.

Romney announced his education plan would refocus Pell Grant money to students who need the most financial assistance by limiting eligibility and limiting the maximum award of grants.

His plan, “A Chance For Every Child,” also promotes families to save for their children’s education instead of depending of government assistance for education.

He said in his Education Plan document that continuing to flood colleges with federal dollars gives Universities the opportunity to continue to raise tuition costs. Instead, Romney supports institutions that pursue innovative operating models to drive down costs.

“Endless government support only fuels skyrocketing tuition. And at a time when America is facing record deficits and debt, more spending is simply not an option,” Romney said in TIME magazine.

The Pew Research Study also found that 40 percent of households headed by someone 35 or younger have debts over 25,000 for years after their graduation from higher education.

To help decrease the burden of paying on student loan debt, Obama introduced “Pay as You Earn,” an income-based repayment program. The program applies to students who enroll in 2014 or later and would cap monthly payments at 10 percent of the applicant’s income and forgives the balance of a student’s debt after 20 years of payment.

In addition, teachers, nurses, military members and other public service workers have the opportunity for their student debts to be forgiven after 10 years of payments.

According to Insight Into Diversity, more than 1.2 million new borrowers are expected to participate in the income based repayment program.

Wilson said a plan for students to discharge student loans in bankruptcy would also be favorable.

On the contrary, Romney rejects the idea of forgiving debts and expects the private sector to inform students of the importance of paying back their debts and reminds them of their obligations to repayment.

“While the president has decided to nationalize the student-lending process, I believe that private-sector competition is more important than ever,” Romney said. “Students and their families must be given the information they need to intelligently weigh the costs and benefits of the many options available to them.”

Election Face Off

Candidates speak about higher education

Channing Parfait

•

November 1, 2012

Leave a Comment

More to Discover